These Properties Are All Available To Purchase Today.

All SFR are available with 10% down Seller Financing with 10% down Owner Occupant only.

$4,550,000 121 Unit Apartment Complex 59TH AVE & Northern ( Phoenix )

7841 N. 59th Ln.

Glendale, AZ 85301

Cross Streets: 59th Ave & Northern

APN: 143-41-006-A

Built: 1974

Lot Size: 2.86 Acres

Taxes: 32,736.80 (2012)

Unit Mix:

Studio (625 sqft): 12 units

1bed/1bath (725 sqft): 44 units

2bed/1bath (925 sqft):65 units

Occupancy: Approximately 95% Occupied (Owner)

Purchase Price: $4,550,000 Cash/Hard Money Only

Approximate Rental Income:

Studio @ $550.00 x 12 units = $6,600.00 monthly gross rents

1bed/1 bath @ $600.00 x 44 units = $26,400.00 monthly gross rents

2bed/1 bath @ $700.00 x 65 units = $45,000.00 monthly gross rents

$936,000.00 approx. yearly gross rents

Rent Roll for the last 12 months: $720,234.00 yearly gross rents

$720,234 yearly gross rents/ 12 months = $60,019 monthly gross rents

Approx Expenses:

Taxes: $32,737 approx 4.5% of Gross Rent

Insurance: $18,220 approx 2.5% of Gross Rent

Payroll: $26,400 approx 3.6% of Gross Rent

Total Utilities: $197,166 approx 27.3% of Gross Rent

Utility breakdown:

City Of Glendale Water: $56,530

SouthWest Gas: $21,537

APS: $119,098

Vacancies & Maintenance: $83,008 approx 11.5% of Gross Rent

Approx Net Rents:

$720,234 gross rents - $357,531 approx expenses = $362,703 yearly net rents

$362,703 yearly net rents/ 12 months = $30,225 monthly net rents

ROI & CAP RATE:

ROI: $720,234/$4,550,000= 16% ROI

Cap Rate: $362,703/$4,550,000=8% Cap Rate

VALUE ADD:

- Only 20 units left to finish as all the heavy lifting was completed last year to rehab over 100 units

- Expense will be lower due to less labor for repairs, less Property Management in use

- Rental income will be higher for 2013 as units are rehabbed and vacancies are a lot lower (more income /less expenses)

****2013 Projections****

- First 4 month Income: $257,787 / 4 months = $64,446 a month X 12 months = $773,352 a year

- First 4 months expense: $114,800 / 4 months = $28,700 a month X 12 months = $344,400 a year

- NOI Projection : $773,352 (gross income ) - $344,400 = $428,952 ( NOI yearly ) / 12 months : $35,746 ( NOI Monthly )

- CAP 2013 Projection: $428,952 ( NOI) / $4,550,000 ( Purchase price ) = 8% Cap rate

- ( 2% increase on cap and 4% decrease on expense ratio due to repairs being handled, lower down units along with lower vacancies

FINANCING:

Cash/Hard Money ONLY

TERMS:

-Open escrow with $100,000 earnest deposit at our Title Company.

-14 Day Close

-Cash or Hard Money only. Property comes in "AS-IS" condition. Buyer pays all closing costs and escrow fees.

-Buyer to receive P & L’s, Rent Rolls once the escrow is opened during the 5 day inspection.

-Please do not disturb tenants or property management.

Glendale, AZ 85301

Cross Streets: 59th Ave & Northern

APN: 143-41-006-A

Built: 1974

Lot Size: 2.86 Acres

Taxes: 32,736.80 (2012)

Unit Mix:

Studio (625 sqft): 12 units

1bed/1bath (725 sqft): 44 units

2bed/1bath (925 sqft):65 units

Occupancy: Approximately 95% Occupied (Owner)

Purchase Price: $4,550,000 Cash/Hard Money Only

Approximate Rental Income:

Studio @ $550.00 x 12 units = $6,600.00 monthly gross rents

1bed/1 bath @ $600.00 x 44 units = $26,400.00 monthly gross rents

2bed/1 bath @ $700.00 x 65 units = $45,000.00 monthly gross rents

$936,000.00 approx. yearly gross rents

Rent Roll for the last 12 months: $720,234.00 yearly gross rents

$720,234 yearly gross rents/ 12 months = $60,019 monthly gross rents

Approx Expenses:

Taxes: $32,737 approx 4.5% of Gross Rent

Insurance: $18,220 approx 2.5% of Gross Rent

Payroll: $26,400 approx 3.6% of Gross Rent

Total Utilities: $197,166 approx 27.3% of Gross Rent

Utility breakdown:

City Of Glendale Water: $56,530

SouthWest Gas: $21,537

APS: $119,098

Vacancies & Maintenance: $83,008 approx 11.5% of Gross Rent

Approx Net Rents:

$720,234 gross rents - $357,531 approx expenses = $362,703 yearly net rents

$362,703 yearly net rents/ 12 months = $30,225 monthly net rents

ROI & CAP RATE:

ROI: $720,234/$4,550,000= 16% ROI

Cap Rate: $362,703/$4,550,000=8% Cap Rate

VALUE ADD:

- Only 20 units left to finish as all the heavy lifting was completed last year to rehab over 100 units

- Expense will be lower due to less labor for repairs, less Property Management in use

- Rental income will be higher for 2013 as units are rehabbed and vacancies are a lot lower (more income /less expenses)

****2013 Projections****

- First 4 month Income: $257,787 / 4 months = $64,446 a month X 12 months = $773,352 a year

- First 4 months expense: $114,800 / 4 months = $28,700 a month X 12 months = $344,400 a year

- NOI Projection : $773,352 (gross income ) - $344,400 = $428,952 ( NOI yearly ) / 12 months : $35,746 ( NOI Monthly )

- CAP 2013 Projection: $428,952 ( NOI) / $4,550,000 ( Purchase price ) = 8% Cap rate

- ( 2% increase on cap and 4% decrease on expense ratio due to repairs being handled, lower down units along with lower vacancies

FINANCING:

Cash/Hard Money ONLY

TERMS:

-Open escrow with $100,000 earnest deposit at our Title Company.

-14 Day Close

-Cash or Hard Money only. Property comes in "AS-IS" condition. Buyer pays all closing costs and escrow fees.

-Buyer to receive P & L’s, Rent Rolls once the escrow is opened during the 5 day inspection.

-Please do not disturb tenants or property management.

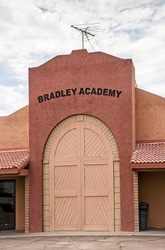

$445,000 Off Market Commercial Former Charter School One Acre 11,700 sq ft. ( Avondale I-10 & Dysart )

Address: 200 N Dysart Rd, Avondale, AZ 85323Cross Streets: Dysart & Western

APN: 500-20-019-C

Zoned: C2

Two Buildings

Total Apprx Sq/ft: 11,713 sq/ft

Lot Sq/ft: 44,596 sq/ft

Built: 1979

Block Construction

Purchase Price $725,000 (Terms Below) or Cash Price $700,000

NEW PURCHASE PRICE: $445,000 APPROX PRICE PER SQ/FT: $38.00Seller is flying back from Africa in 2 weeks, wants to focus on wife and not worry about making repairs or carrying a note. He is so motivated he is willing to take a $280,000 discount to make sure it liquidates quickly! Potential Rents: $10,000 per month*

-Was previously rented out by a Charter School for 3 years at $10,000 a month.

Details:

Former Charter School; “Bradley Academy Charter School” and prior to that it was a church. Near parks, hospital, medical centers, shopping, restaurants, I-10-, and Loop 101. Property was listed in 2009 for $750K on MLS, however due to the appreciating market conditions the market values have increased in this area, and the seller is making it even more desirable by offering extremely affordable & favorable terms.

- Seller has another Charter school who may want to rent out at the same lease price as the previous school was renting for the last 3 years at $10,000 a month

- Sell to a church, Non Profits, Private Organizations, and Day Cares.

- Have the ability to sale to a big box store: Wal-Mart, Costco, Home Depot, and Lowes

- Over an Acre of C-2 zoned building with over the 11,000 sqft already in place with great terms

Items that may need addressing include; drywell, flooring, minor plumbing, paint, a few windows, carpet, cleaning throughout, replace a couple of doors, and ceiling panels.

Roof and A/C appear to be in good condition. Seller has also agreed to make a reasonable Seller Credit to help offset roof or A/C unit if they happen to need extensive repair.

ROI & Cap Potential:

- $10,000 month income X 12 mo = $120,000 ( gross income )

- 50 % expense ratio ( to account for repairs, vacancies, taxes, insurance ect ) 120k X 50% = $60,000 ( a year in Net Income )

- $60,000 ( NOI ) / $725,000 ( purchase price ) = 8.2% Potential Cap rate

return - $120,000 ( Gross Income ) / $725,000 ( purchase price ) = 16.5% ROI

- $60,000 ( NOI ) / $445,000 ( purchase price ) = 13.4% Potential Cap rate

- $120,000 ( Gross Income ) / $445,000 ( purchase price ) = 26.9% ROI

FINANCING: Cash/Hard Money/Terms

TERMS:

Open escrow with $10,000 non refundable earnest deposit with a cashier's check made out to our Title Company of choice; please contact us for more details. Cash, Hard Money or Terms only. Property comes in "AS-IS" condition. Buyer pays all closing costs and escrow fees.

$1,350,000 Exclusive Off Market / 19 Units / .03 Miles from ASU / 7% Cap / 100% Occupied

Address: 1116 E Lemon St, Tempe, AZ 85281

Cross Streets: Rural & Apache

APN: 132-73-155 & 156

Taxes: $6,064.98 (2012)

Built: 1960

Lot Size: .68 Acres Total

Building Size: 10,208 SF Total

19 Units:

-1=Studio

-18=1bed/1bath

Occupancy:

Fully Occupied

Rents:

All Units are rented out by one organization for a total of $9,500 monthly rents. Tenants have been in place for several years.

Purchase Price: $1,350,000 Cash/Hard Money

Approx. Price Per Door: $71,000

Details:

Property has been well maintained for several years by the same tenants. Tenants to start new 2year lease upon Close of Escrow and they have two 2year option for extending. Therefore, there is a 6 year potential occupancy and the organization has no intention of leaving since they have been there for the past 4 years. Property maintenance is paid $300 a month to notify owner if there are any areas of concern or correct maintenance issues. All units are individually metered and owner pays taxes, insurance, and property maintenance. Subject property sits in central Tempe. It is near Arizona State University, Mill Avenue, Arizona Mills, Tempe Town Lake, ASU Stadium, Interstate 10, Loop 202, Route 60, Route 143 and Loop 101.

Upside:

-Within extremely close proximity to Arizona State University: 5 minute WALKING distance/ 0.3 miles!

-Located within 1 block from a light rail station

-Units are currently under rented.

-Currently 100% Occupied.

-Own almost a full acre in central Tempe.

-State Farm regional HQ set for Tempe in massive $600 million development (link for article below )

http://www.bizjournals.com/phoenix/news/2013/05/24/state-farm-regional-hq-set-for-tempe.html?ana=e_phx_bn&u=G60zVahlAH87+GrmppeKLw09dafa18&t=1369431793

ROI & CAP Rate

**Monthly rents $9,500 x 12 = $114,000 total yearly gross rents

**Monthly Maintenance/Prop Manager= 300 x 12 = $3,600 yearly

Adj. Gross Income $114,000

Maintenance/Prop Manager (3,600)

Insurance (4,100)

Property Taxes Total (2012) (6,065)

Reserves/Contingency (5,000)

Total Expenses ($18,765)

Net Operating Income: $95,235

ROI: $114,000/$1,350,000 = 8.4% ROI

CAP: $95,235/$1,350,000 = 7.0% Cap Rate

ACCESS: Call to set up inspection.

DO NOT DISTURB TENANTS OR PROPERTY MANAGER!!!

(THIS INCLUDES KNOCKING ON DOORS, TALKING WITH THE TENANTS OR PROPERTY MANAGER/MAINTENANCE, ETC)

FINANCING: Cash/Hard Money

TERMS:

-Open escrow with $50,000 refundable earnest deposit with a cashier's check made out to our Title Company of choice; please contact us for more details.

-$50,000 earnest gives you a 5 day inspection period then earnest becomes non-refundable on the 6thday. We will provide rent rolls/ P & L for subject property.

-20 day close.

-Cash, Hard Money only. Property comes in "AS-IS" condition. Buyer pays all closing costs and escrow fees.

-All Security Deposits will be transferred at the COE.

-Please do not disturb tenants or property management/maintenance. Call us to set up an inspection.

$1,512,000 Exclusive / 36 Condo Units / 16th ave and Glendale / 7% Cap

Address: 1609 W Glendale, Phoenix, AZ 85021

Cross Streets: 15th Ave & Glendale

Built: 1972

APN: 156-17-026+

36 Units:

-13= 2bed/1bath (approx. 856)

-20=2bed/2bath (approx. 950)

-3=2bed/2bath (approx. 1,096)

Occupancy:

5- vacant

31- Occupied

Rents:

2bed/1bath=$670

2bed/2bath=$???

3bed/2bath= $1,000/$1,000/$1,275(Avg $1,091)

***#’s not adding up to 25K

Purchase Price: $1,512,000 Cash/Hard Money

Price Per Door: $42,000

Gross Income:

$25,000 monthly gross income x 12= $300,000 approx. monthly gross income

ROI & CAP

Item: Per Year $____

Gross Rents: 300,000

HOA: $375 per unit [10,800]

*HOA has a blanket insurance [162,000]

(covers; electric, gas, sewer, trash)

Taxes: $300 per unit [10,800]

Vacancy @ 3% [9,000]

Maintenance Estimate [12,000]

Total Expenses (193,800)

NOI: $106,800

ROI: $300,000/$1,512,000= 19.8% ROI Potential

CAP: $106,800/$1,512,000 = 7.0% Cap Rate Potential

ACCESS: Call to set up inspection.

FINANCING: Cash/Hard Money

TERMS:

-Open escrow with $50,000 refundable earnest deposit with a cashier's check made out to our Title Company of choice; please contact us for more details.

-$50,000 earnest gives you a 5 day inspection period then earnest becomes non-refundable on the 6thday.

-Cash, Hard Money. Property comes in "AS-IS" condition. Buyer pays all closing costs and escrow fees.

-Buyer to receive P & L’s, Rent Rolls once the escrow is open during the 5 day inspection.

-All Security Deposits will be transferred at the COE.

-Please do not disturb tenants or property management. Call us to set up an inspection.

$110,000 Duplex ( Phoenix )

The property has a lot size of 7,275 sqft and was built in 1987. The average listing price for similar homes for sale is $145,775 and the average sales price for similar recently sold homes is $113,811. 745 E Mission Ln is in the North Mountain neighborhood in Phoenix, AZ. The average price per square foot for homes for sale in North Mountain is $142.

$139,000 4 Plex ( Phoenix )

939 E Turney Ave, Phoenix, AZ, 85014

This 2520 square foot multi family home has 4 bedrooms and 4.0 bathrooms.

2 separate single story building on the south side of E Turney Ave just east of N 7th St.

3 x 1 bed / 1 bath - 540 sqft units

1 x 2 bed / 1 bath - 900 sqft unit

total 4 rentable units, approx 2,520 sqft

Individually metered units (electricity, gas, cable)

Parcel # 155-14-015 12,992 sqft lot size

Built in 1946

Masonry construction with wood / steel frame and pitched asphalt shingle roofs.

6 parking spots

Current Occupancy – vacant, needs rehab

Taxes in 2012: $ 1,008 No delinquent taxes

Tenant pays electric, cable, gas Owner pays water, sewer, trash

Estimated Rent Range

1 bed / 1 bath, 540 sqft @ $ 450 - 550 2 bed / 1 bath, 900 sqft @ $ 550 - 650

This 2520 square foot multi family home has 4 bedrooms and 4.0 bathrooms.

2 separate single story building on the south side of E Turney Ave just east of N 7th St.

3 x 1 bed / 1 bath - 540 sqft units

1 x 2 bed / 1 bath - 900 sqft unit

total 4 rentable units, approx 2,520 sqft

Individually metered units (electricity, gas, cable)

Parcel # 155-14-015 12,992 sqft lot size

Built in 1946

Masonry construction with wood / steel frame and pitched asphalt shingle roofs.

6 parking spots

Current Occupancy – vacant, needs rehab

Taxes in 2012: $ 1,008 No delinquent taxes

Tenant pays electric, cable, gas Owner pays water, sewer, trash

Estimated Rent Range

1 bed / 1 bath, 540 sqft @ $ 450 - 550 2 bed / 1 bath, 900 sqft @ $ 550 - 650

$299,000 8 Condos Available with Seller Financing with $89,700 down (Central Phoenix)

SOLD

8 Condos - 1819 N 40th St

40th Street and McDowell

$299,000

2 bed

2 bath

$89700 down

8 Condos - 1819 N 40th St

40th Street and McDowell

$299,000

2 bed

2 bath

$89700 down

$96,000 3 Bed 1 Bath 1619 sq ft. 19TH AVE & Cactus ( North West Phoenix )

$98,000 Commercial Office Available for Seller Financing with $34,000 Down ( Central Phoenix )

Central Phoenix

1806 W Peoria Ave

19th Ave & Peoria

$98000

Commercial bed

Office bath

$34500 down

1806 W Peoria Ave

19th Ave & Peoria

$98000

Commercial bed

Office bath

$34500 down

$79,000 Duplex 5 Bedrooms 2 Bath Seller Financing with $23,850 Down ( Centralphoenix )

Central Phoenix

3704 E Polk St

36th St & Van Buren

$79,000

5 bed

2 bath

$23850 down

3704 E Polk St

36th St & Van Buren

$79,000

5 bed

2 bath

$23850 down

$27,500 2 Bed 2 bath Seller financing with $8250 Down ( Phoenix )

Sold

West Valley

2150 W Missouri Ave # 113

19th Ave & Missouri

$27,500

2 bed

2 bath

$8250 down

West Valley

2150 W Missouri Ave # 113

19th Ave & Missouri

$27,500

2 bed

2 bath

$8250 down